Running an online WooCommerce store is rewarding. However, it comes with challenges, especially when collecting online payments. Between declined cards and abandoned carts, an unfriendly payment process can hurt your profits. That’s where benefits of Stripe comes in.

Payment gateway Stripe is a leading payment processor trusted by millions of businesses worldwide. With Stripe, you get a stripe payment limit, streamlined checkout, global reach, robust security, valuable insights, time savings, easy integration, and helpful support.

These features directly translate into more sales, happier customers, and operational efficiencies for your WooCommerce store.

This blog post will explore seven key benefits of using Stripe as a payment gateway for your e-commerce business.

Table of Contents

- Streamlined Checkout

- Global Reach, Global Sales

- Security You Can Trust

- Frictionless Data, Informed Decisions

- Effortless Reconciliation, Saved Time

- Developer-Friendly Integration

- Seamless Support, Peace of Mind

- Key Takeaways

- Final Words

Why You Need to Use Stripe

There are so many reasons to use Stripe payment gateway. There are various companies that use stripe features as it can easily be integrated with other platforms, such as buyCred Stripe. Here are some reasons mentioned below:

Stability – One of The Top Stripe Features

Stripe has a strong infrastructure and is renowned for its low downtime and seamless transaction processing. Stripe features lessen the possibility of mistakes or hold-ups during crucial checkout times. Stripe further emphasizes security with features like firewalls, intrusion detection systems, and frequent penetration testing.

Additionally, the gateway considers compliance with the Payment Card Industry Data Security Standard (PCI DSS), which guarantees the secure transfer and storage of private cardholder information.

A Universal Payment Gateway

Stripe payment gateway integrates with various online platforms for setting up and accepting payments on your app or website. For example, myCred is integrated with Stripe. This payment gateway also accepts major credit cards and more than 135 currencies. As a result, its clients can take payments from clients worldwide without having to worry about compatibility problems or currency conversions.

Payment Transparency – One of The Highlight Stripe Features

For both your company and your clients, payment gateway Stripe provides a clear charge schedule, fair pricing, and no hidden fees.

Businesses sent each transaction’s specifics, such as the amount, currency, client information, and any related fees. This degree of transparency makes financial administration and reconciliation simple.

Streamlined Checkout

A smooth, fast checkout experience keeps customers happy and boosts conversions. In fact, Stripe claims a 42% increase in conversion for businesses using Stripe Checkout.

With payment gateway Stripe, you can:

- Enable one-click payments – Returning customers can checkout instantly using saved payment details.

- Offer Apple Pay and Google Pay – Customers can check out with a single tap using mobile wallets.

- Prevent failed payments – Stripe screens cards and suggests SCA authentication to minimize declines.

- Leverage global payment methods – Alternative options like Alipay increase international conversions.

The above Stripe features create frictionless checkout flows. Minimal form fields, saved details, and global payment methods remove checkout pain points. Customers stay happy, and you sell more.

Stripe Offers Global Reach and Global Sales

Selling globally opens up new revenue streams for your WooCommerce business. With Stripe, you can expand your online business internationally with ease as Stripe lets you:

- Accept payments in 135+ currencies, including USD, EUR, GBP, CAD, AUD, and more.

- Get localized payment methods for over 40 countries like SEPA, Alipay, and more.

- Convert currencies automatically so you get payouts in your desired currency.

For example, UK-based WooCommerce store Cuckoo Candles expanded globally using Stripe:

“We recently expanded to selling in euros and dollars, which again was very easy to set up with the WooCommerce Stripe extension.”

Whether you’re going into international waters or want to grab a global customer base, the Stripe payment gateway makes cross-border e-commerce sales seamless.

Security You Can Trust

Is stripe checkout safe? This question arises instantly. Security is paramount when we talk about Stripe. It eases this burden with next-to-none security measures. Stripe payment gateway safeguards your store with:

- PCI compliance – Stripe meets stringent card data security standards. No compliance headaches for you.

- Bank-grade data encryption – Customer card details are secure using AES-256 and TLS encryption.

- Fraud prevention – Stripe Radar uses AI to detect suspicious activity and prevent fraud.

- Regular security audits – Stripe undergoes independent audits to identify and address risks proactively.

According to Stripe, these methods have prevented over $1 billion in fraud to date. With Stripe, security is baked in. You can focus on your business, knowing customer payments are in safe hands. is stripe checkout safe: the answer is a resounding YES.

Frictionless Data and Informed Decisions

Home decor brand Ivy Muse increased revenue by 75% in one year after analyzing Stripe analytics to optimize their checkout and product lineup.

Data powers smart decisions. Stripe provides rich analytics and insights into your store’s performance. With Stripe, you gain visibility into:

- Key metrics – Track total sales, average order value, conversion rates, and more.

- Payment trends – See declines, dispute rates, and reasons to optimize your checkout process.

- Customer details – Identify your best customers and shopping behavior patterns.

Data should inform, not overwhelm. Stripe surfaces key insights so you can make high-impact decisions that boost your business.

Effortless Reconciliation and Saved Time

According to users, Stripe reconciliation saves 2-3 days per month typically spent on manual tasks.

Managing order finances is a chore. Thus, benefits of Stripe includes simplifying back-end operations so you can focus elsewhere. Stripe offers conveniences like:

- Automatic payouts – Transfers arrive on schedule with no manual work needed.

- Dispute management – Stripe handles chargebacks and disputes for you.

- Single payments dashboard – All transaction details are in one place for easy reconciliation.

Streamlined finances give you time back. Stripe automates the busy work so you can spend more energy growing your online business.

Benefits of Stripe Include Developer-Friendly Integration

A payment gateway should fit seamlessly into your e-commerce operations and not cause headaches. Payment gateway Stripe plays nice with WooCommerce. With Stripe payment gateway, you get:

- Officially supported plugin – The Stripe for WooCommerce plugin integrates Stripe in minutes.

- Customizable checkout – Tailor Stripe Checkout or Elements to match your storefront.

- Webhooks and APIs – Build custom integrations using Stripe’s robust developer tools.

- Detailed docs – Examples and guides to integrate Stripe quickly and easily.

Talking about the integration, myCred offers seamless add-on integrations. myCred offers two products:

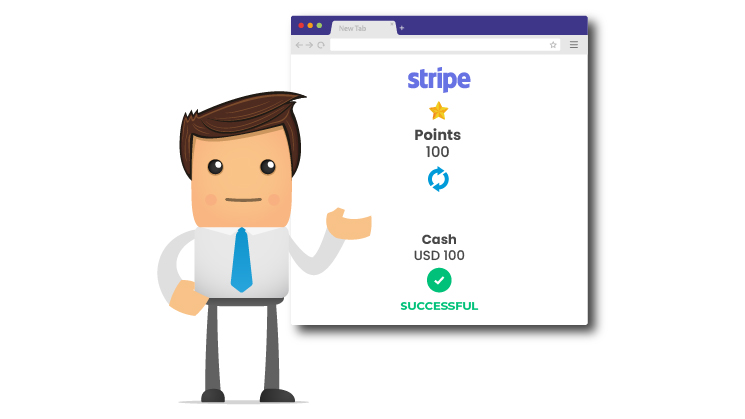

cashCred Stripe

This myCred addon enables users to redeem myCred points into cash using the Stripe payment gateway. You can manually or automatically withdraw points while adjusting currency rates as well. To read more about this addon, click here.

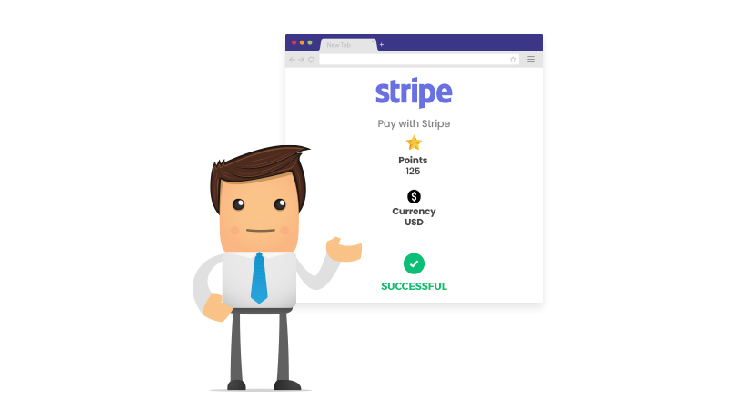

Stripe – buyCred Gateway

This myCred addon supports point purchases and subscriptions using Stripe’s Checkout script. It enables you to manage clients’ credit card payments by syncing the buyCred Stripe addon with your Stripe account. To learn more about the add-on.

Overall, the Stripe payment gateway works FOR you, not AGAINST you.

Seamless Support with Peace of Mind

Running into payment issues can be stressful. Stripe payment gateway offers dedicated 24/7 support through multiple channels. You get access to:

- 24/7 live chat – Get immediate answers to your questions from a Stripe rep.

- Phone support – For urgent needs, call Stripe support anytime.

- Extensive help docs – Stripe’s searchable knowledge base solves common queries.

- Active community – Ask fellow users questions and get help on the Stripe subreddit.

With reliable support at your fingertips, you don’t have to fret over payment problems on your own. Stripe has your back when you need it.

Is Stripe Checkout Safe?

The answer to this complex topic largely depends on what you offer and how you sell it. Stripe’s structure and procedures may make it less secure as a payment gateway than other Stripe alternatives. Here is why.

Stripe Does Not Act as a Merchant Account

Stripe is not a genuine merchant account. This type of gateway is known as a 3rd-party payment aggregator. This implies that rather than giving each company a separate merchant account, it aggregates transactions from different companies.

This adds a degree of danger even though it speeds up and simplifies the setup procedure. Without a specialized merchant account, businesses may lack control and support, leaving their transactions more vulnerable to problems and disruptions.

Suspended Accounts and Frozen Funds

If Stripe finds an activity that violates its terms of service or if it determines that a business model poses a significant risk, it has a history of freezing or deleting accounts with little to no notice. This is one of the top benefits of Stripe that helps you to ascertain whether Stripe is safe or not.

Stripe account suspensions will be problematic for businesses that sell supplements, coaching services, advice, travel or event tickets, subscriptions, and dropshipping, to name a few.

Transaction Volume Trigger for the Month

Stripe is safe for e-commerce business owners who operate in low-risk categories and handle the amount of less than $20,000 per month.

However, the risks of account termination and freezing rise in tandem with transaction volumes. Further, what company doesn’t desire to increase revenue?

At first, Stripe payment gateway could be secure, but it may soon become a risk.

In a nutshell, Stripe is PCI DSS Level 1 certified, the highest standard for payment security. This means it follows strict guidelines to protect cardholder data. The platform also uses TLS (Transport Layer Security) encryption to safeguard data transmission, ensuring that payment information remains private.

Stripe employs tokenization, replacing actual card details with unique tokens to prevent exposure of sensitive information. This reduces the likelihood of fraud and enhances security. Moreover, Stripe payment gateway’s automatic updates ensure its security protocols remain compliant with industry standards.

Key Takeaways of Benefits of Stripe

Here are the top benefits of Stripe along with its significance with WooCommerce integration:

- Smoother checkout and higher conversions

- Global sales with multi-currency support

- Bank-level security and fraud prevention

- Valuable store insights using Stripe analytics

- Time savings from automated reconciliation

- Seamless integration with WooCommerce

- Responsive 24/7 support resources

Final Words on Benefits of Stripe

If you’re looking to improve your payment operations, Stripe is worth exploring. Its balance of revenue growth features, Stripe payment limit, and back-office efficiencies can transform your online business.

Are you considering integrating Stripe with WooCommerce? Check out the official Stripe plugin to get started with a free 30-day trial.