The only way countries can survive is to collect taxes from residents and spend that money on national matters (budget), infrastructure, and social welfare. But it’s not easy to motivate people & businesses to pay taxes on time and the actual amount. Tax Gamification can help governments to collect better tax revenue using gamified tactics.

Let’s read the article!

What is Fiscal Capacity?

The ability to raise revenue from taxes – called “fiscal capacity” – is a crucial aspect of the functioning of any state. Being able to tax citizens, and collect revenues efficiently, is a cornerstone of state formation and survival. Secondly, greater fiscal capacity implies greater state access to resources needed to provide public goods and services.

The Main Problem For Government: Citizens and private businesses usually hide their true assets & annual income to avoid tax payments and involve themselves in tax evasion.

Effective Solution: Reward-based tax gamification can play a crucial role in collecting better tax revenues.

Let’s explore how gamification can help authorities motivate taxpayers to pay their dues before the final deadline.

The Taiwanese Government Model For Tax Gamification (Rolling Rewards)

Taiwanese government used gamification (Rolling Rewards) to ensure tax compliance in 1951.

First Step – The Taiwanese government unified all receipt and invoicing systems into a central system. All businesses that give out a receipt would have the unique receipt number and amount sent to the government for tax reporting.

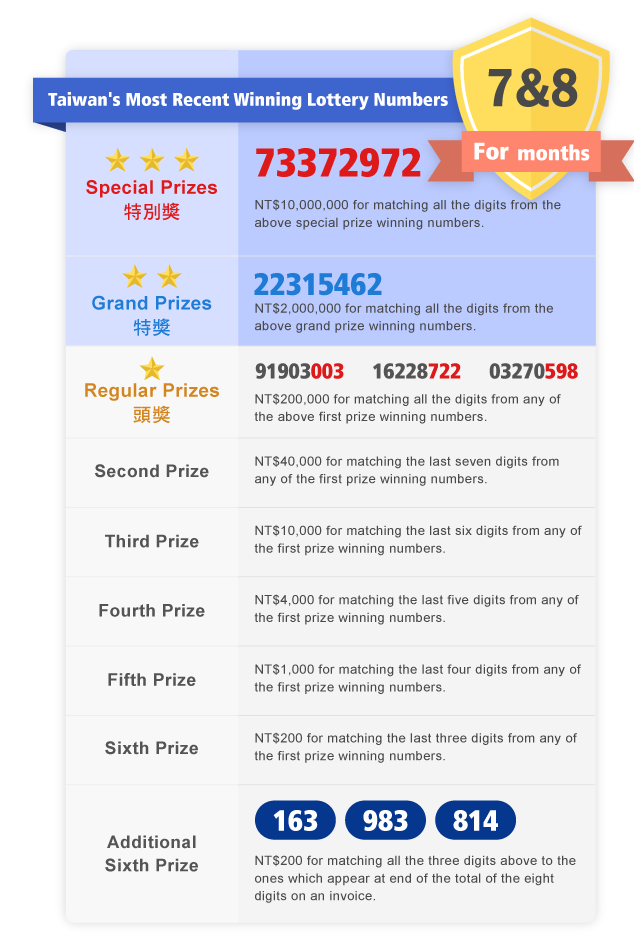

Second Step – They turned each receipt and invoice number into a lottery ticket for citizens to play. For every odd-numbered month, citizens can see if their receipt numbers match the winning numbers. Because of this “Uniform Invoice Lottery” system, consumers now demand receipts and invoices from businesses, preventing businesses from evading taxes by exchanging cash under the table. Not only that, consumers are likely to be willing to spend more since every time they make a purchase, they can become a winner, boosting the economy in the process.

As a result of the Uniform Invoice Lottery (Rolling Rewards), the Finance Ministry collected 75% more in tax revenue in 1951 compared to 1950.

Now after discussing a result-oriented approach towards gamifying the taxation process, let’s have a look at different types of taxes individuals and businesses pay in most countries.

Three Major Types of Taxes & Their Branches

#1 Taxes on What You Earn

Individual Income Taxes:

An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns.

Corporate Income Taxes:

A corporate income tax (CIT) is levied by federal and state governments on business profits, which are revenues (what a business makes in sales) minus costs (the cost of doing business).

Payroll Taxes:

Payroll taxes are taxes paid on the wages and salaries of employees to finance social insurance programs.

Capital Gains Taxes:

In jurisdictions with a capital gains tax, when a person “realizes” a capital gain—i.e., sells an asset that has increased in value—they pay tax on the profit they earn.

#2 Taxes on What You Buy

Sales Taxes:

Sales taxes are a form of consumption tax levied on retail sales of goods and services.

Gross Receipts Taxes:

Gross receipts taxes (GRTs) are applied to a company’s gross sales, regardless of profitability and without deductions for business expenses.

Value-Added Taxes:

A Value-Added Tax (VAT) is a consumption tax assessed on the value-added in each production stage of a good or service.

Excise Taxes:

Excise taxes are taxes imposed on a specific good or activity, usually in addition to a broad consumption tax, and comprise a relatively small and volatile share of total tax collections.

#3 Taxes on Things You Own

Property Taxes

Property taxes are primarily levied on immovable property like land and buildings and are an essential source of revenue for state and local governments.

Tangible Personal Property (TPP) Taxes

Tangible personal property (TPP) is a property that can be moved or touched, such as business equipment, machinery, inventory, furniture, and automobiles.

Estate and Inheritance Taxes

Both estate and inheritance taxes are imposed on the value of an individual’s property at the time of their death. While estate taxes are paid by the estate itself, before assets are distributed to heirs, inheritance taxes are paid by those who inherit property.

Wealth Taxes

Wealth taxes are typically imposed annually on an individual’s net wealth (total assets, minus any debts owed) above a certain threshold.

myCRED PROPOSED A COMPREHENSIVE MODEL TO GAMIFY TAX COLLECTION PROCESS:

What is myCred?

myCred is the most powerful and easy-to-use points management system that allows you to build and manage a broad range of digital rewards, including points, ranks, and badges on your WordPress/WooCommerce powered website. It is easy to set up and works with a vast library of third-party software. myCred has an extensive collection of affordable premium addons that can help you create a lucrative reward system that is perfect for your site.

#1 Reward Points To Taxpayers:

myCred (Points management plugin) can help government officials to reward points (registered taxpayers on a WordPress-powered site) for paying taxes like income tax, sales tax, property tax, and wealth taxes. The greater they pay due taxes, the greater they earn redeemable points. Later taxpayers are able to convert their gamification points into real money using the myCred cashCred addon or can use them for other utilities like online shopping, etc.

#2 Reward Badges to Taxpayers:

Badges are considered suitable rewards when a taxpayer reaches or gains a specific number of points. You can use the myCred core plugin (Open Badge Module) to reward badges to taxpayers. Along with the core plugin, you can use add-ons like myCred Badgr, etc.

#3 Reward Ranks to Taxpayers:

Rewarding ranks to taxpayers based on their points & badges uplift their motivation to a new level and make them feel accomplished. Humans are by nature competitive and anything that boosts their self-esteem drives them for the desired action.

Gamification-Based Progress Bar OR Progress Map Can Motivate Taxpayers To Pay Taxes:

Progress Bars or Progress Map inform users about the status of ongoing processes and track their progress, and view steps to achieve the specific status. By installing myCred Progress Bar or myCred Progress Map you can motivate taxpayers to pay taxes to achieve special rewards.

Using visual representations of their efforts and tempting milestones, you can push taxpayers to do more. No one wants to lose their hard-earned points and to roll back their already developed progress. Progress Bar can prove itself a fruitful strategy to collect better revenue and to gamify the tax process.

Wrapping Up!

Tax collection on a larger scale is not a piece of cake and it has involved a lot of complexities. However, you can motivate taxpayers to pay taxes using gamification tactics and reward them with suitable privileges and perks.